Homeowners Insurance in and around Richmond

Richmond, make sure your house has a strong foundation with coverage from State Farm.

Help cover your home

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

Being at home is great, but being at home with coverage from State Farm is the ultimate luxury. This fantastic coverage is more than just precautionary in case of damage from fire or windstorm. It also has the ability to protect you in certain legal situations, such as someone falling in your home and holding you responsible. If you have the right coverage, these costs may be covered.

Richmond, make sure your house has a strong foundation with coverage from State Farm.

Help cover your home

Why Homeowners In Richmond Choose State Farm

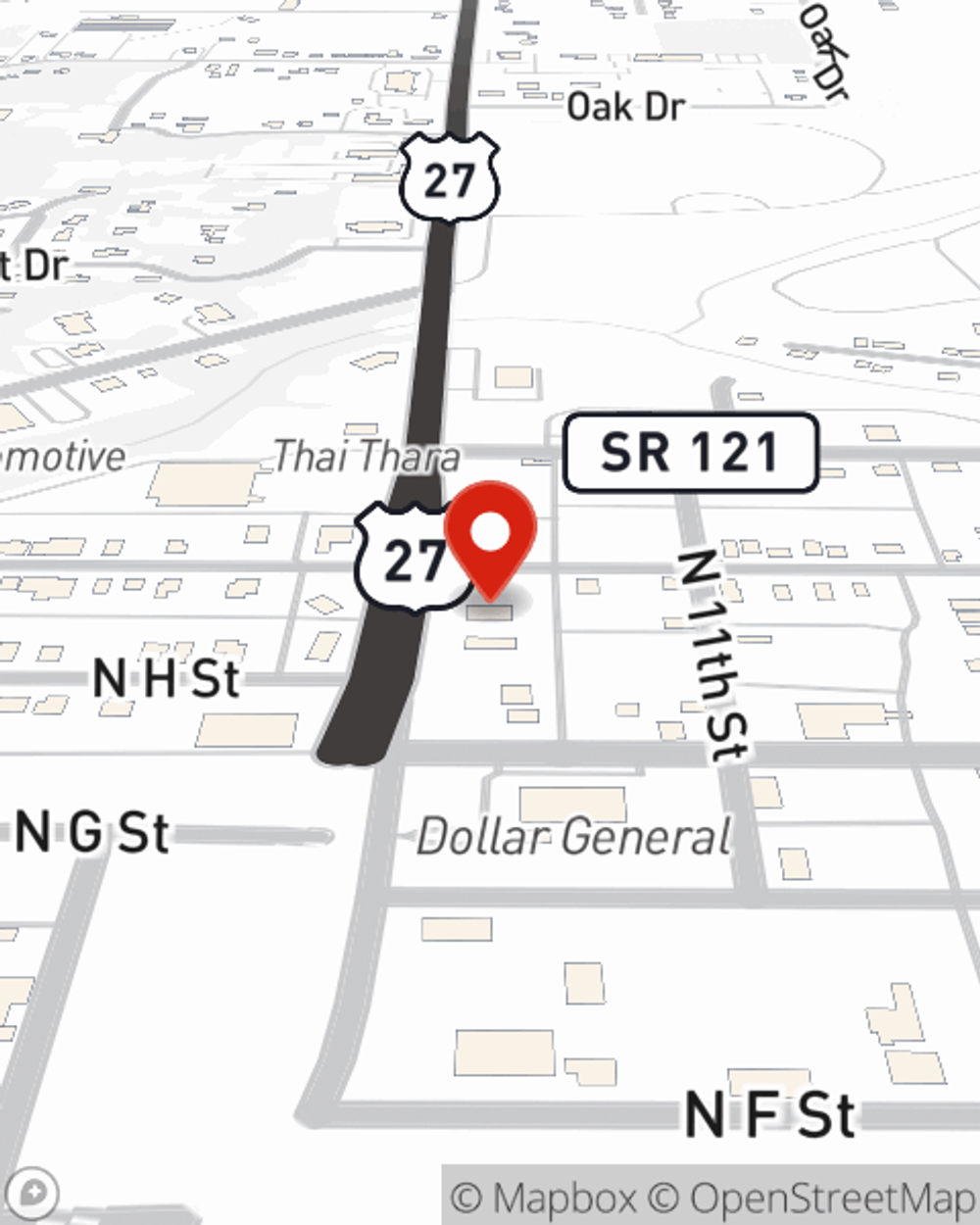

That’s why your friends and neighbors in Richmond turn to State Farm Agent Angie Witherby. Angie Witherby can help you understand your liabilities and help you select the smartest policy for you.

For terrific protection for your home and your keepsakes, check out the coverage options with State Farm. And if you're ready to lay the foundation for a home insurance policy, contact State Farm agent Angie Witherby's office today.

Have More Questions About Homeowners Insurance?

Call Angie at (765) 935-7348 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Backyard structures and home insurance

Backyard structures and home insurance

Do you have detached structures or a swimming pool on your property? Learn how they're covered by home insurance.

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Backyard playground and trampoline safety tips

Backyard playground and trampoline safety tips

These outdoor playground and backyard trampoline safety tips can help keep everyone safe. Don’t take unnecessary risks.

Angie Witherby

State Farm® Insurance AgentSimple Insights®

Backyard structures and home insurance

Backyard structures and home insurance

Do you have detached structures or a swimming pool on your property? Learn how they're covered by home insurance.

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Backyard playground and trampoline safety tips

Backyard playground and trampoline safety tips

These outdoor playground and backyard trampoline safety tips can help keep everyone safe. Don’t take unnecessary risks.