Business Insurance in and around Richmond

Richmond! Look no further for small business insurance.

Insure your business, intentionally

Cost Effective Insurance For Your Business.

Operating your small business takes creativity, time, and terrific insurance. That's why State Farm offers coverage options like errors and omissions liability, extra liability coverage, worker's compensation for your employees, and more!

Richmond! Look no further for small business insurance.

Insure your business, intentionally

Protect Your Business With State Farm

Your company is one of a kind. It's where you make your living and also how you grow your life—for yourself but also for your loved ones, and those who work for you. It’s more than just a store or an office. Your business is your life's work. Doing what you can to keep it safe just makes sense! That's why one of the most sensible steps is to get outstanding small business insurance from State Farm. Small business insurance covers a plethora of occupations like a landlord. State Farm agent Angie Witherby is ready to help review coverages that fit your business needs. Whether you are an electrician, an acupuncturist or a pharmacist, or your business is a camera store, a window treatment store or a clothing store. Whatever your do, your State Farm agent can help because our agents are business owners too! Angie Witherby understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

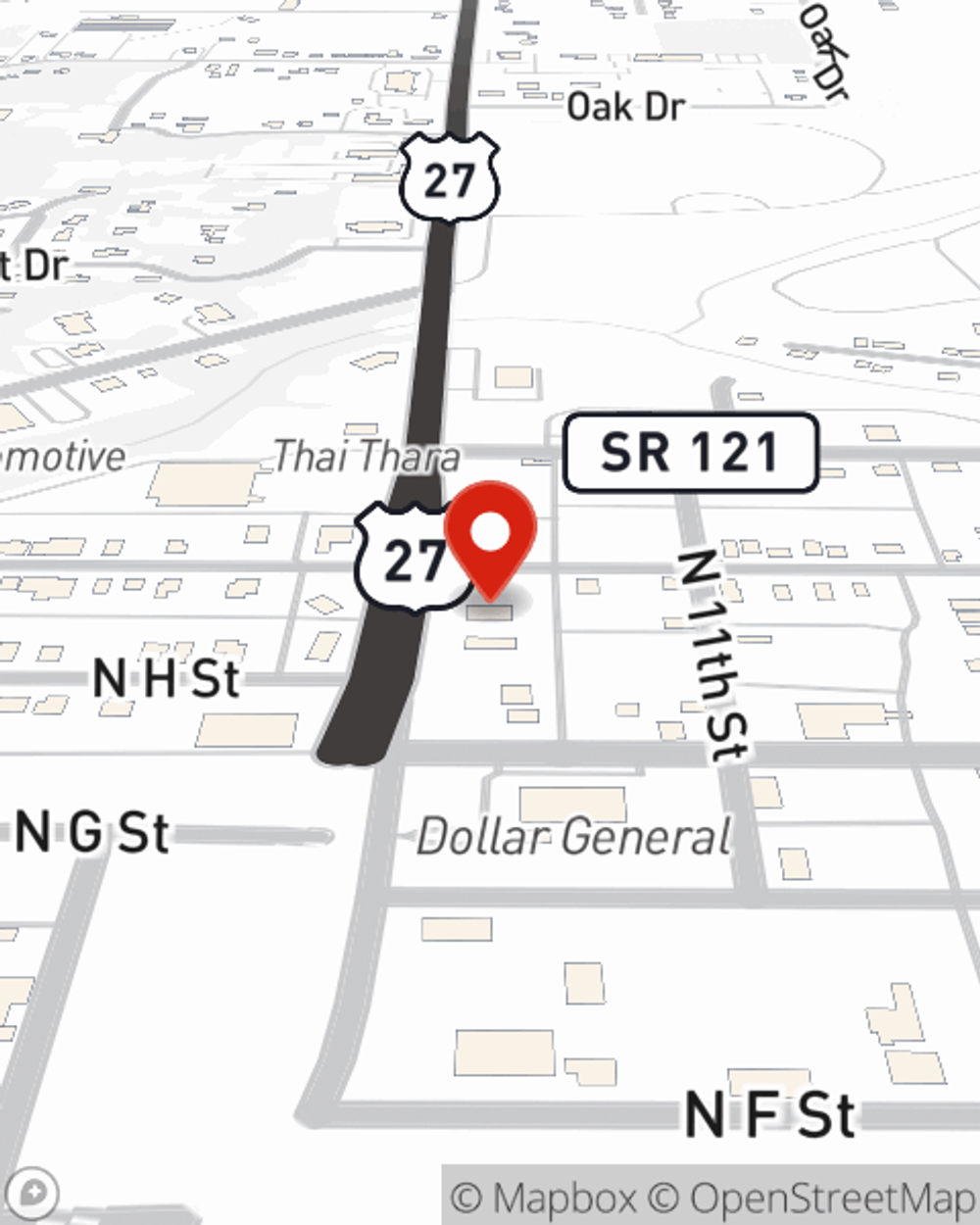

Get right down to business by getting in touch with agent Angie Witherby's team to discuss your options.

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Angie Witherby

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.